Colloquy Podcast: Who’s Afraid of Inflation?

How worried should consumers be about rising prices?

Research at Risk: Since World War II, universities have worked with the federal government to create an innovation ecosystem that has yielded life-changing progress. Now much of that work may be halted as funding is withdrawn. Find out more about the threats to medical, engineering, and scientific research, as well as how Harvard is fighting to preserve this work—and the University's core values.

Prices are up sharply on cars, food, fuel, and many other items. What’s behind the spike? Is there too much money in the economy? Is it a supply chain problem? And is this a long-term trend or just a bump on the road as the country's economy recovers from the economic shocks of the pandemic? In the October 2021 episode of the Colloquy podcast, GSAS alumna Betsey Stevenson, professor of public policy and economics at the University of Michigan and a member of the Council of Economic Advisers during the Obama Administration, sifts through the data and gives her take on how worried consumers should be about inflation.

NOTE: This transcript has been edited for clarity.

Last winter, my wife and I were thinking of getting a new car. We found one we liked but weren’t quite ready to buy. We checked recently and the same make and model was $5,000 to $10,000 more than the one we almost bought in January. What happened? Is it simply too many dollars chasing too few goods and services? Or is that way of looking at inflation too simplistic in the current environment?

Oh, I think that is pretty much a good description of what happened for you with cars. And it's a shocking number. If we take a look at used cars and trucks, the BLS reported that as of September the price was up 24.4 percent over the 12-month period. So that's a big price rise. If you're looking at new vehicles, they were up 8.7 percent over the 12 months. So, we're definitely seeing some price rises there.

But when you take a look at the used cars and trucks, you see that some of this is just the chaos that has come out of the ending of the pandemic. Or should I say the slowdown of the pandemic, where I think demand has gotten a little bit ahead of supply.

So, if you take a look at those used cars and trucks, what we saw was prices actually came down in August and September. And we rarely see that. So not only did the big increases that we were seeing in used cars and trucks stop so that inflation ground to a halt, but actually it reversed a little bit in August and September.

And I think, for me, that says what was going on in the vehicle market was demand. All those dollars out there, people ready to get back out on the road. Let's get that car. And the cars just weren't there. So supply wasn't ready for the increase in demand.

There were four stories at the top of the New York Times homepage this morning, and all of them were about inflation or supply chain woes. The Consumer Price Index climbed 5.4 percent. The International Monetary Fund lowered its projection for global growth, partially because of fears of inflation. Is this just a bump in the road back from the pandemic or the start of a long-term trend?

I mean, I'll tell you, honestly, I don't think anybody can really answer that. The hope is that these price increases are all transitory. And as things start to settle back down, we'll see inflation start to settle back down to around 2 percent, which is what most of the central banks around the world aim for.

When prices rise faster than that—particularly when they rise unexpectedly faster or when we don't really have a handle on what's going to happen to them—it causes a change in people's behavior. And that change in people's behavior can have an impact on growth. And that's why you're seeing those forecasts being revised down—what will people do when they see rising prices?

Now, I think that it's always worth putting it in context that there are winners and losers from inflation. So I'm not advocating for us to have higher inflation. That's not a good thing. But I do think it's important to realize that not everybody really loses.

The people who lose the most are retirees and people who are trying to live off a fixed set of income that they thought was going to be able to purchase a certain amount of goods and services for them. And if the prices all go up, well, then they're not going to be able to buy as many goods and services with the money they set aside, particularly if they haven't put it in a place where it's going to earn interest that keeps up with inflation.

I'm not advocating for us to have higher inflation. That's not a good thing. But I do think it's important to realize that not everybody really loses.

That's why you sometimes hear people talk about putting their savings somewhere where it's going to give a real return—so they're insured against losing any money due to inflation. But most people don't have their savings in that kind of form.

So we see savers tend to lose. And what we see is that people who are net borrowers actually tend to gain. Because what they end up having to pay back becomes worth less in terms of the goods and services they would be buying with that money. So it becomes easier to pay back that mortgage that you've got on a fixed interest rate. It becomes easier to pay back that student loan on a fixed interest rate. So those are the winners from unexpected inflation.

The losers are the savers. And the problem is that creates a lot of turmoil in the financial services industry because obviously, the banks were counting on you paying things back in with dollars that were going to be worth a little bit more. And so that creates that chaos that I think people start to really worry about.

President Biden announced—I guess it was this morning—that the Port of Los Angeles would be open 24 hours a day, 7 days a week. Do you think that's going to have an impact on the supply chain and therefore, have an impact on inflation?

So some of the complaints about the US ports in LA have been that the Chinese ports went down. But when they come back up, they work 24/7. And we need the LA Port to be receiving 24/7. What that's going to do is when the things make it to the US shores, we're going to try to get them unloaded a little bit faster. It's not just about unloading at the ports.

You also saw that President Biden was working with major companies that move goods around the country, like UPS and FedEx, and Walmart, asking them to work 24/7 to move those goods as quickly as possible. Because we have to unload them. We have to get them in trucks. We have to ship them to where they're going to create space on the dock. Because even if you're working 24/7, you're going to run out of space on the dock.

So you need the whole system to be working a little bit more smoothly. Working 24/7 isn't necessary to make the US supply chain work. But it might be necessary, at this particular moment, to make sure that we minimize our role in creating clogs in the supply chain because there are clogs all over. Everyone's been saying this phrase, "they're supply chain problems." But it's worth asking, “What does that actually mean?”

And there are three things going on that are clogging up the US economy. One is that people are getting sick around the globe. And so goods aren't getting to where they need to be. And that's leaving container ships stranded. So you've got stuff to put in a container ship in Port A, but the container ship ended up in Port B. And then we get things together, and we're missing a part. So that's one big thing that's going on. But there are two other factors that are going on.

A second factor is just changes in US consumers' demand, so really trying to figure out what it is that can—you as consumers want and getting that on the shelves for them. And because our lives were changed by COVID, that's ended up changing the things that we want to buy in a way that suppliers are having to work harder than they did prior to the pandemic to predict and get those things on the shelves quickly.

And then there's a third factor that's affecting prices and supply chains. And that's that people are panicking a little bit. And they are doing the equivalent of a bank run on goods. So they're out there at the store thinking, if I don't buy this now, there might not be any left for when I want it. So my mom told me last weekend, I need to buy my Thanksgiving turkey now and put it in my deep freezer because she's terrified there's going to be no turkeys for Thanksgiving.

So imagine I listen to my mom, and I go out there and buy that turkey. Imagine my mom tells that to other people. They all think, oh, my gosh, everybody's buying their turkey. I better buy my turkey now. It becomes a self-fulfilling prophecy.

It's not that there weren't enough turkeys for Thanksgiving. But it's that my mom told everybody to go out there, and the news told everybody that there might not be enough turkeys. And everyone thought, if I think that you think that somebody else thinks that you need to buy the turkey now, then they buy the turkey now. And then I buy the turkey now because my best response to you buying the turkey now is to buy the turkey now.

So that idea of a run on products—we're seeing that in the economy. I don't know if that's going to happen with turkeys for Thanksgiving. And I'm certainly not trying to promote that. But we've definitely seen that happen with toilet paper in the US. We saw that happen a little bit with hand sanitizer.

But I thought it was really interesting to see that Costco learned its lesson from 2020, and it's already restricting people to buy one big thing of Costco toilet paper. It's not they don't have enough toilet paper. They just don't want you buying two, three big things of Costco toilet paper, maybe causing a panic among other people who are like, oh, if they're buying all that toilet paper, I should buy more toilet paper now. So Costco is doing the right thing to try to say, hey, just buy one. It's OK. There'll be more next time you come to Costco.

You're a labor economist. Last Friday, the jobs numbers came out and people were concerned: under 200,000 jobs were created in September. Were you concerned? And do you think that inflation's having any impact on the employment market?

I don't think that was about inflation. That was about the pandemic. That was about COVID and the Delta variant. And I really wasn't that surprised to see that number. What I'd like to see is more people vaccinated. I'd like to see fewer cases. Where I live, we just had an elementary school go virtual because there are so many cases. A lot of the moms I know, a lot of the dads I know, they're having to shuffle around what they're doing because their kids are now all home.

That's happening all over the country. And it's happening—even if the school doesn't shut, the kids are sick. And the workers are sick. You go to that jobs report in September and what we saw was a very high rate of people working part-time because they were too sick to work full-time. We saw 1.5 million people out of work because they were too sick to work. And we saw an increase in the number of people who weren't at their job because the job site had closed due to COVID.

What [the Bureau of Labor Statistics does with the employment report] is they go out, and they interview people in a particular week. This was the second week of September. The second week of September the average COVID cases were 200,000 cases a day across the country.

We're in the second week of October. The case rate's down below 100,000. This is our reference week for the next jobs report. I never make forecasts. But I feel very confident saying today we're going to see more jobs added in October when we get that report at the beginning of November. And that's because the number of people out of work due to being sick and the demand for in-person goods and services, all those things track the COVID case rates. We've been saying this since March of 2020—the virus drives the economics here.

What we saw in September, this wasn't about inflation. It wasn't about supply chain issues. It was about the Delta variant. Is it—do inflation and supply chain issues potentially have an impact slowing things down? They do. And we will want to be keeping an eye on that as we go forward.

But I think right now that's not the primary factor. So if you look at what's happening at, let's say, meals at restaurants. It wasn't food away from home where we saw big price increases. It was food at home where we saw the bigger price increase in September. And so what's stopping people from [going to] restaurants? It's not the price increases. It's not having to pay restaurant workers more. It's their fear of COVID. And in fact, Morning Consult tracks people's comfort level with dining indoors. And you saw that it sort of peaked in early July. And it's been—and it then came down. And it hasn't really come back very much. Just the last couple of weeks, it started to recover a little bit.

What we saw in [the September employment report], this wasn't about inflation. It wasn't about supply chain issues. It was about the Delta variant.

You can do the same thing for things like comfort levels traveling, comfort at in-person entertainment. All of those things, the comfort level peaked in July and has come back down. Now, there's a glass half full and glass half empty story there. That's kept airline prices from rising. So that's been maybe deflationary pressure or something that's keeping inflation numbers down.

So what happens when all of a sudden we want to do everything? Does that—and there's not enough stuff for us to do, that could create inflationary pressure. That's exactly the kind of transitory inflationary pressure that the Fed’s been warning about and that we have seen, which is what—if demand moves faster than supply can move, then their response is typically higher prices, at least in the short run.

So what's the implication for policy then? There are two big bills in front of Congress right now. There's an infrastructure bill that I think is around $1 trillion dollars. And then there's the $3.5 trillion reconciliation bill. From a macroeconomic perspective, how worried do you think policymakers should be about the deficit and the debt? And should there be any concern, for instance, about countries switching from the dollar as their reserve currency?

One question that you might have is, “How concerned should we be that the government goes out and spends all this money and creates additional inflationary pressure?” So let's just start from that point. And to that I would say, the irony is that any time you say, hey, why don't we pass these kinds of bills to deal with a recession, you hear a lot of economists say, oh, the problem is by the time they get the spending done, we won't be in a recession anymore.

Because those things are long-term projects that take a long time to get off the ground. And so I think you have to be looking at them, not from a business cycle perspective, but from a long-run investment perspective. So now, then what is that—should we be borrowing for them? Should we be increasing the debt? Should we be running deficits in order to pay for things that are investing in the future?

And I think what we have to be asking there is what's the return? And is the return justified by what we're borrowing? Is it about consumption? Sometimes that's OK. We spend on older people. Not because they're going to be more productive and help us raise GDP down the line, but because we want to improve the quality of life of our oldest citizens.

But when we spend on our children, it's not just consumption. We actually do think they're going to be more productive citizens down the road. And so there, there's a return. And we do need to think about that a little bit differently, I think. And that kind of spending, I do think, is justified, regardless of the amount you have to borrow to do it.

There's a more—I'm almost going to call it a philosophical question—which is, “How much debt is too much debt?” And I say philosophical because I don't think anybody really knows the answer to that. We've seen Japan exist with very high debt to GDP ratios for some time now. We've seen countries' debt to GDP ratios rise without causing, really, any kind of havoc in the broader global macroeconomy. But that doesn't mean that that can go on and on and on forever. So that—where is that limit? How much is too much?

I don't think that anybody has a really good answer to the question of how much is too much. I do think there are reasons to be worried that the US is less attractive. But I worry there more about things like the debt ceiling creating the optics that US treasury bills aren't as safe as we once thought they were. The question about dollarization—will other countries use fewer dollars—I don't think that I see that as something that is a concern.

My concern would be if people don't want to invest in the United States. So, they don't want to lend money to the US government. They don't want to invest in US businesses. And that doesn't just mean foreigners not coming to the US to invest. But it means Americans saying, I don't really know if I want to invest my money in this country.

You know, these savings, they've got to be there for me when I retire. So I'm going to put my money in Australia. Or I'm going to put my money in Europe. Or I'm going to put my money in Asia. Then what we see is people thinking the US is not a great destination.

We should always think about that. We should be an attractive place. I think there are lots of reasons, though, that we could become unattractive that have nothing to do with [the fact that] Congress passed a bill that gave universal child care, or that Congress passed a bill that gave universal preschool, or paid leave to families, or started to address climate change, and now the US has become unattractive. I actually worry more that we don't address these problems, and the US starts to become unattractive because we're just not keeping up with where the rest of the world is.

One of the articles at the top of the Times homepage this morning mentions concern in equities markets about a return to 1970s style stagflation. What happened in the late '70s? And how did it change the way economists and policymakers thought about inflation?

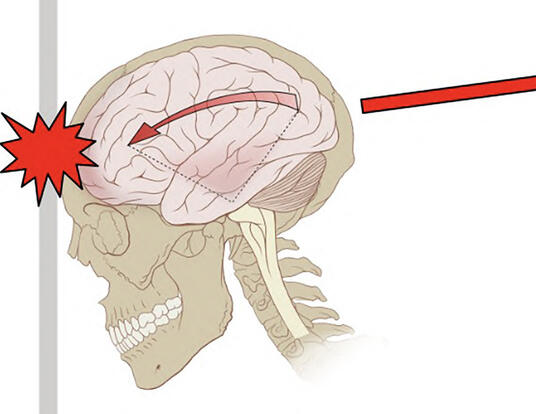

So stagflation is when we have high inflation, which means that we want to raise interest rates to try to slow the economy down. But if you have slow growth, you don't want to slow the economy down. You want to speed the economy up. So how do you fight inflation if what you actually need to do is actually get everybody producing more? And I think that was our big challenge.

The fear is that that happens again. That we're in a world where growth is slow but prices are going up. And the Fed, maybe, has to figure out what it wants to try to do; really squash price increases, which could really slow down economic growth for quite some time, or try to get economic growth back up and keep hoping that they can keep long-term inflation expectations in line?

Having inflation run a little hot, which means a higher inflation rate than normal for a year or two, so that's where we're at right now. We're running 5.4 percent inflation over the last 12 months. That's hot inflation for the United States. It's not crazy. It doesn't mean that you need to hurry up and spend everything you've earned because you're not going to be able to buy as much stuff next month. But it does mean that, now, our money in our pocket is losing more value than it normally does. And that's very disconcerting.

The question is whether that's going to stop anytime soon. And in order to understand whether it's going to stop on its own, we really have to have some idea as to what's causing it. And I think the thing that's challenging for the Fed right now is this isn't—what's happening are not the kind of things where they need to slow the economy down.

There may be some places that people are worried about, like the housing market. So, low interest rates have caused people to think about getting out there and buying a bigger house. The banks have been really tough in terms of approving mortgages. So we're not going to end up with the kind of 2008 problems of people getting underwater on their mortgage. But it has meant that people are willing to buy a bigger house. And that's pushed demand up. And that's pushed housing prices up. So I think that there are people taking a look at the Fed and saying, “Hey, you did that and you need to rein that in.”

But for some of the other things where we're seeing prices going up, there's nothing the Fed can do about supply chain problems. Trying to slow down investments by raising interest rates is not going to get the economy to a better place faster. It's not going to get the economy growing any faster. And in fact, I think what's particularly tough for the Fed right now is that the question is whether we need more investments so that we can deal with the rapidly changing consumer demand.

And I do think that people are changing what they're buying. We all started buying masks. Are we going to keep buying masks? Do they need to ramp up production and distribution of masks or scale that back? What about at-home tests for COVID? There's a bunch of things where we're changing what we're doing and supply is struggling to keep up.

And luckily, we have an economy full of people who are ready to make a buck by moving in the direction that demand is going and trying to build out that supply as fast as possible. And the cheap money that the Fed is providing makes it easier for people to actually respond to that demand. So that's fantastic.

But cheap money, well, it also fuels demand. And so that's the chase, or the trade-off, that the Fed is facing. Do they want to keep giving all those incentives to people to go out there and try to meet that demand by making money as cheap as possible for them? Or do they need to reign in money from the consumer side, so that they're reining in demand? And I think that Chairman Powell has said this directly himself. These are tough times for them. I'm not going to stand here and tell you I know the answer for what they should do. But I think that is the very rough waters that they're currently navigating.

Last question in light of the past couple of employment reports, which have been disappointing: We're going into winter now. You've noted that the [COVID] infection rate is actually down across the country from where it was a month or so ago. How are you feeling about the trajectory of the economy in 2022? Are you feeling more optimistic or less?

So, I can tell you a story full of optimism. And I think it is well within our potential to reach. My story full of optimism is that the vaccine mandates work. More people get vaccinated, COVID stays with us but is no longer deadly—or is no longer more deadly than the flu. It is a manageable illness that circulates certain times of the year, and we get booster vaccines for [it]. And we start to get back to our normal life. And that happens around the globe. So all the clogs we've seen in the global supply chain get cleared up.

We have enormous productivity growth that comes out of everything we learned in trying to address the pandemic. The pandemic has caused so many technology innovations to move forward at lightning speed because of necessity. So we all learned how to use Zoom. That's at the private level. But within companies, they've pushed forward investments in technology and things that would enhance productivity.

We're already starting to see some of those productivity gains per hour worked, so we enter a period where we get all these productivity gains from what we learned during the pandemic. And we're able to come into 2022 with a little bit of a readjustment of bargaining power between companies and workers so that workers are back to work. We fully recover our employment rate. But we see workers with more job satisfaction and fewer people who are paid below a living wage, more people who are in jobs that provide them the flexibility they need to care for their family. And we see very rapid growth that's coming, not from catch up, but from our enhanced ability to produce by taking advantage of those technology gains over the last couple of years and the productivity gains that can come from being in a job that's a better match for you.

So all of this churn that's happening right now, it can push us into a place where the economy is stronger than ever. That is certainly possible for us. I'm a very optimistic person, so that's where I think we're going. Obviously, that's where I want us to go.

It's possible, though, that we end up with really massive political fighting that slows things down. We're seeing some states trying to prove their political chops by saying, we're not going to allow any company to mandate a vaccine. That's going to slow any kind of COVID recovery down. And it's a little confusing to companies who are used to being able to set their own personnel policies. And it's confusing to OSHA, which has to decide—are companies doing the right thing in terms of keeping their workers safe? Do you still fine a company if they're letting workers come to work with COVID and unvaccinated if they weren't allowed by state law to change that? So we've got a lot of tumultuous stuff going on.

All of this churn that's happening right now, it can push us into a place where the economy is stronger than ever.

We could see a new variant emerge right here in the United States, or it could come from overseas. It could be deadlier. It could transmit faster. And that's what we saw with Delta. But it could be worse than Delta. And it could—the worse thing, of course, would be if it was unable to be defeated, or tamped down, by the vaccine, we'd end up back at square one.

So there's a range of possible outcomes where the worst possible outcome is we're in a terrible place where we're unable to deal with all this debt because we're dealing with another raging public health crisis. A much better outcome is we learn a whole lot of lessons. And we are really prepared for the next public health crisis so that it doesn't cost us as much in terms of lives or dollars. The truth is that there's a whole middle range of outcomes in there as well. And they all have probability weights on them. I think it's most likely that we come out stronger. And I say that because, historically, the US and other developed countries have been able to rally in a way that leads us out of a crisis.

And I think if you look around the globe, even when we see countries that have struggled differently with the crisis, like Australia, which had its real crisis moment in 2021 with lockdowns in New South Wales, big lockdowns in Victoria in 2020. But they're now—Canberra, the capital city of Australia is looking to come out the most vaccinated city in the world, any day now.

So there's a lot of optimism to be had out there. And I think there's a lot of movement in the right direction.

The Colloquy podcast is a conversation with scholars and thinkers from Harvard's PhD community on some of the most pressing challenges of our time—from global health to climate change, growth and development, the future of AI, and many others.

About the Show

Produced by GSAS Communications in collaboration with Harvard's Media Production Center, the Colloquy podcast continues and adds to the conversations found in Colloquy magazine. New episodes drop each month during the fall and spring terms.

Talk to Us

Have a comment or suggestion for a future episode of Colloquy? Drop us a line at gsaspod@fas.harvard.edu. And if you enjoy the program, please be sure to rate it on your preferred podcast platform so that others may find it as well.

Get the Latest Updates

Join Our Newsletter

Subscribe to Colloquy Podcast

Simplecast